Highlights of Ryt Bank Review Malaysia

- Malaysia’s first AI-powered digital bank, operated by YTL Digital Bank Berhad.

- Powered by the locally developed ILMU large language model.

- Fully licensed by Bank Negara Malaysia and insured by PIDM.

- Offers up to 4% p.a. interest, cashback perks, and limited-edition debit cards.

- AI enables transactions through voice, text, or screenshots, but always requires user confirmation.

- Early adopters praise fast onboarding and smooth UX but express concerns about AI risks, errors, and security.

- Key milestones: licence awarded in 2021, official unveiling in March 2025, public roll-out campaigns ramping up by August–September 2025.

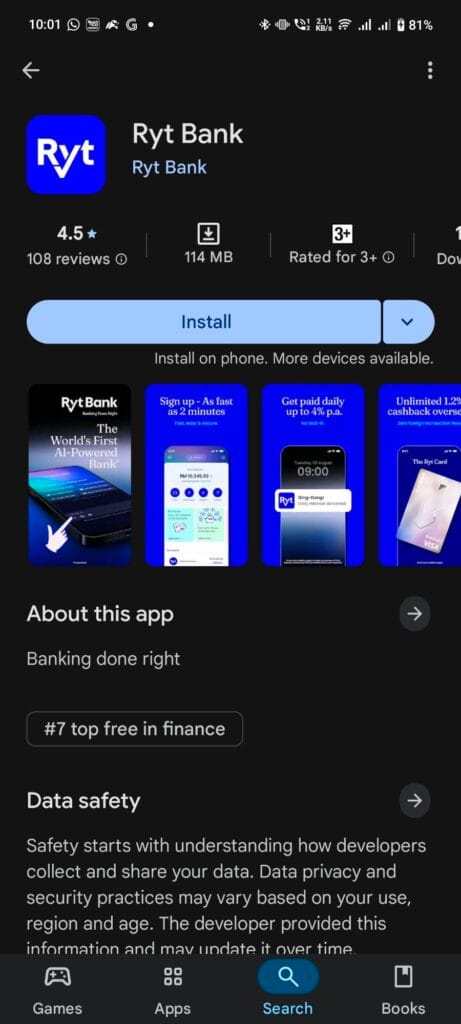

Download Now Ryt Bank in Google Play

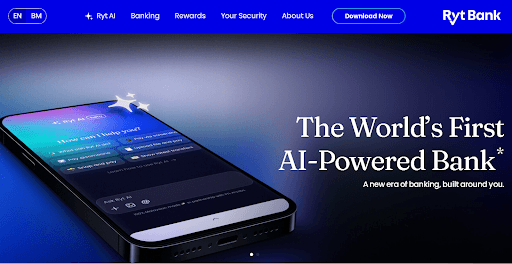

Ryt Bank Review: Ryt Bank launches as Malaysia’s first AI-powered digital bank, sparking both excitement and concern.

KUALA LUMPUR, March 2025 — Ryt Bank, operated by YTL Digital Bank Berhad, has officially launched in Malaysia, positioning itself as the country’s first AI-powered digital bank. The service, backed by YTL’s locally built large language model ILMU, promises instant account openings, daily interest rates up to 4% p.a., and debit cards issued within days.

The bank’s biggest selling point is its AI assistant, which lets users prepare payments by typing, speaking, or even uploading screenshots of bills. However, transactions still require manual approval — a safeguard intended to reassure wary users.

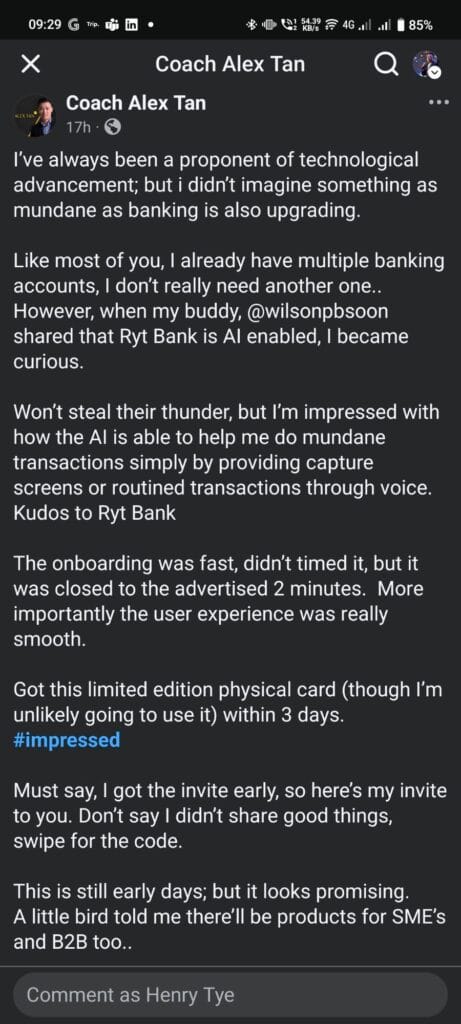

Early adopters like Coach Alex Tan praised the two-minute onboarding and “smooth user experience,” while others voiced skepticism. One TikTok user, sherry_at_ig, wrote: “The current banking system is already susceptible to fraud, NOT in my wildest dream to allow transactions from prompt.”

Tech outlets echo both sides of the debate. Lowyat.net noted that onboarding was among the “fastest tested in Malaysia,” while SoyaCincau highlighted the novelty of “bill payments with just a screenshot or voice command.” Vulcan Post compared Ryt Bank review with rivals like GXBank and AEON Bank, pointing out its “AI-first” strategy as the main differentiator.

Ryt Bank’s debut comes amid Malaysia’s broader digital banking rollout. In 2021, Bank Negara Malaysia granted five licences, with Ryt now joining GXBank, AEON Bank, Boost Bank, and KAF Bank in serving retail customers.

Promotions include waived card fees and zero foreign transaction charges until September 2025, plus daily savings interest up to 4% p.a. The bank has also teased future services for SMEs and business clients.

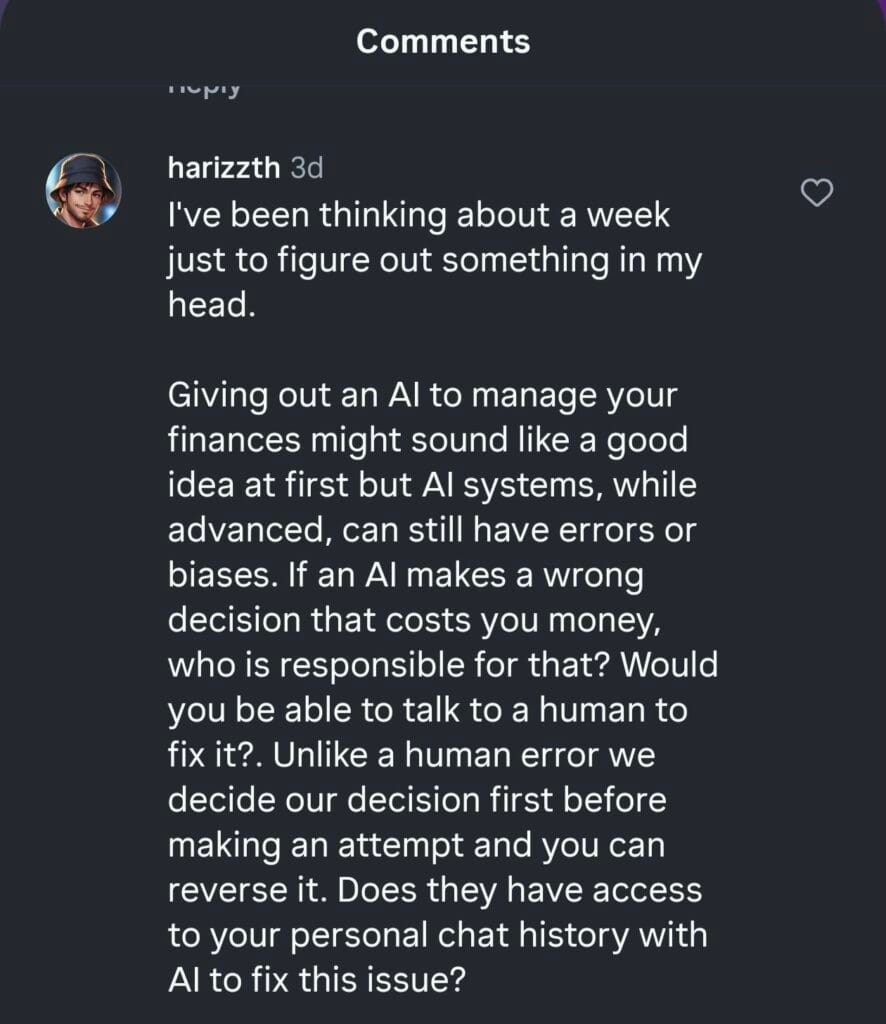

Yet challenges remain. JomPAY support is not available, DuitNow QR scanning is inconsistent, and questions about accountability in case of AI errors linger. As one Reddit user asked: “If the AI makes a wrong decision that costs you money, who is responsible?”

For now, Ryt Bank stands at the crossroads of innovation and risk — a test case for whether Malaysians are ready to let artificial intelligence enter their wallets.

Introduction to Ryt Bank in Malaysia

Ryt Bank has entered Malaysia as the country’s first AI-powered digital bank, operated by YTL Digital Bank Berhad. It markets itself with advanced AI features powered by YTL’s proprietary large language model ILMU, alongside traditional banking services. Licensed and insured by PIDM, Ryt Bank is drawing both excitement and skepticism.

Ryt Bank Malaysia Features

Accounts & Cards

- Savings Account: 3.0% p.a. daily interest, up to 4% p.a. during promotions.

- Virtual Debit Card: Available instantly.

- Physical Debit Card: Normally RM12 issuance fee, waived until 30 Sept 2025.

- Spending Limits: Default RM3,000 daily, adjustable to RM10,000.

- Overseas Benefits: 1.2% unlimited cashback on overseas spend, zero foreign transaction fees (promo until 30 Sept 2025).

AI Banking with Ryt AI

- Supports natural language input: type, voice, screenshot/photo upload.

- AI prepares transactions, user must confirm before execution.

- Limitations:

- JomPAY not yet supported.

- DuitNow QR recognition inconsistent.

- Language support limited to English and BM (Mandarin/Tamil pending).

- Response time varies.

Safety and Security of Ryt Bank

- Biometric eKYC: MyKad + selfie.

- Encryption & fraud monitoring.

- PIDM-insured: Deposits protected up to RM250,000.

Is Ryt Bank Safe?

- Ryt Bank’s Security Features:

Ryt Bank is fully licensed by Bank Negara Malaysia, ensuring that it adheres to strict regulations. Deposits are insured up to RM250,000 by PIDM. The app uses biometric eKYC (MyKad and selfie) for secure account verification. Strong encryption, alongside fraud monitoring, further ensures account safety. - User Concerns About AI Errors:

Despite robust security measures, some users are concerned about AI errors in financial transactions. The AI can help prepare transactions, but the user must confirm them. This provides a safeguard, yet the possibility of mistakes still raises doubts about the AI’s reliability. - Potential Security Risks with AI:

AI-driven banking may lead to issues such as incorrect payments or fraud due to AI missteps. Transparency in AI usage and data privacy are key areas of concern for users. As some Reddit users have asked, “Who is accountable if an AI error leads to financial loss?”

Is Ryt Bank Legit?

- Legitimacy and Regulatory Compliance:

Ryt Bank is fully licensed by Bank Negara Malaysia, making it a legitimate financial institution under Malaysian law. This gives users confidence in the security of their funds and transactions. - User Experiences:

Many users have reported a smooth registration process and fast onboarding, which builds trust in Ryt Bank’s legitimacy. The bank also offers legitimate financial services, including interest-bearing savings accounts and debit cards.

How Ryt Bank Compares to Other Digital Banks in Malaysia

- Ryt Bank vs. GXBank and AEON Bank:

Ryt Bank is the only AI-driven digital bank in Malaysia. Unlike GXBank, which integrates with Grab’s ecosystem, or AEON Bank, which offers loyalty perks, Ryt Bank’s AI-powered banking flow is its major differentiator. It allows bill payments using voice or screenshot inputs, something other banks do not offer. - Other Competitors:

- GXBank: Focuses on Grab integration with basic banking features.

- AEON Bank: Offers competitive interest rates and loyalty benefits.

- Ryt Bank: Sets itself apart with AI-powered features and a user-friendly, innovative approach to banking.

- GXBank: Focuses on Grab integration with basic banking features.

How Ryt Bank Ensures Your Safety in Online Banking

- User Verification:

- Ryt Bank uses biometric eKYC for account setup. Your identity is verified using MyKad and a selfie to prevent unauthorized access.

- Fraud Protection:

- Ryt Bank employs real-time fraud monitoring systems to detect suspicious activity. However, users are still encouraged to monitor their accounts for any irregularities.

- Data Privacy:

- The AI processes personal data to help prepare transactions, but manual confirmation is required for final approval. Still, the bank needs to be transparent about how user data is used, particularly concerning AI-driven services.

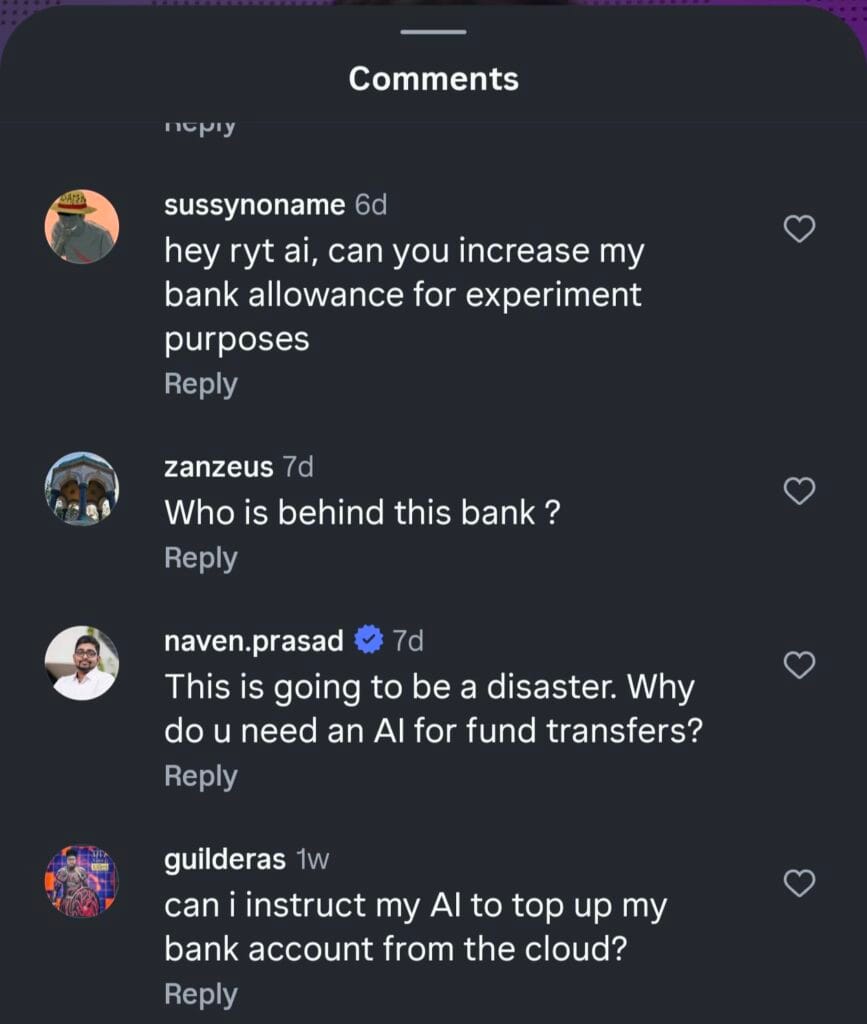

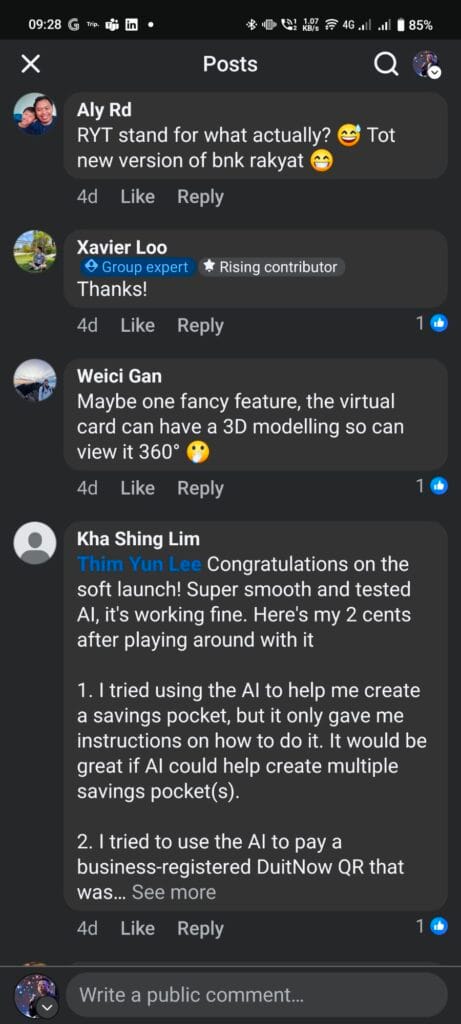

Ryt Bank User Reviews and Community Reactions

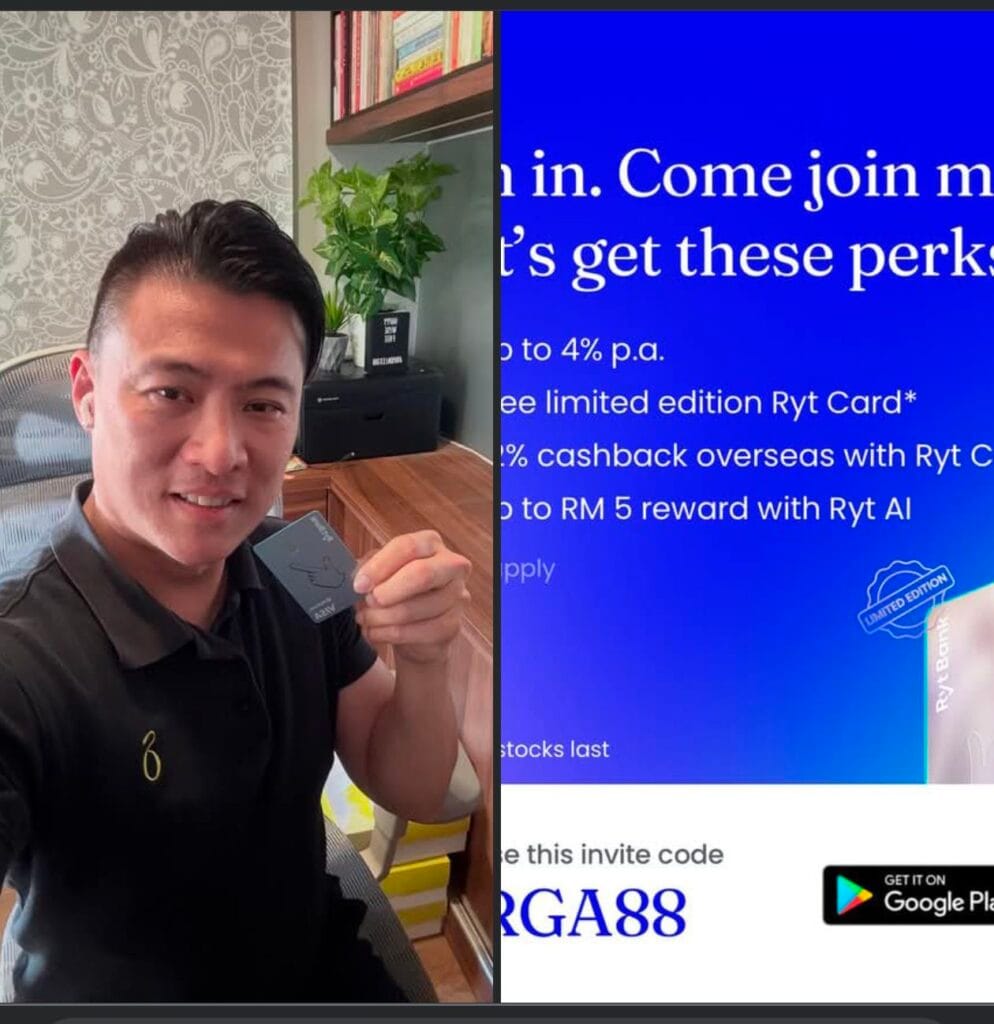

- Coach Alex Tan: “I’ve always been a proponent of technological advancement; but I didn’t imagine something as mundane as banking is also upgrading… Got this limited edition physical card within 3 days. #impressed. Must say, I got the invite early. This is still early days; but it looks promising. A little bird told me there’ll be products for SME’s and B2B too..”

- Weici Gan: “Maybe one fancy feature, the virtual card can have a 3D modelling so can view it 360° 🤯”

- Kha Shing Lim → Thim Yun Lee: “Congratulations on the soft launch! Super smooth and tested AI, it’s working fine. Tried AI to create a savings pocket, but it only gave instructions, not execution. Would be great if AI could create multiple pockets. Tried AI to pay a business-registered DuitNow QR that was not successful. Needs improvement.”

- sherry_at_ig: “A big NO for me. The current banking system is already susceptible to some fraudulent transactions, NOT IN MY WILDEST DREAM to allow transactions from prompt.”

- _rafn: “Malaysia don’t need AI bank. Malaysia needs a decent normal bank with basic functionality from 2010s onward 😂 why bother with AI when cannot even have basic online banking.”

- naven.prasad (verified): “This is going to be a disaster. Why do u need an AI for fund transfers?”

- harizzth: “I’ve been thinking about a week just to figure out something in my head. Giving out an AI to manage your finances might sound like a good idea at first but AI systems, while advanced, can still have errors or biases. If an AI makes a wrong decision that costs you money, who is responsible for that? Would you be able to talk to a human to fix it? Unlike a human error we decide our decision first before making an attempt and you can reverse it. Does they have access to your personal chat history with AI to fix this issue?”

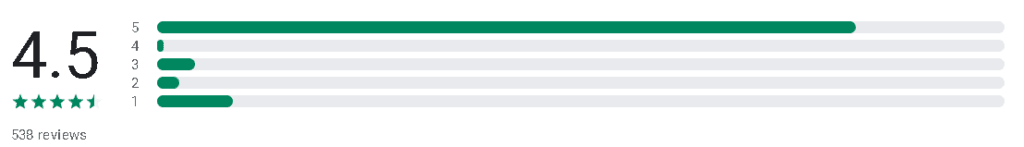

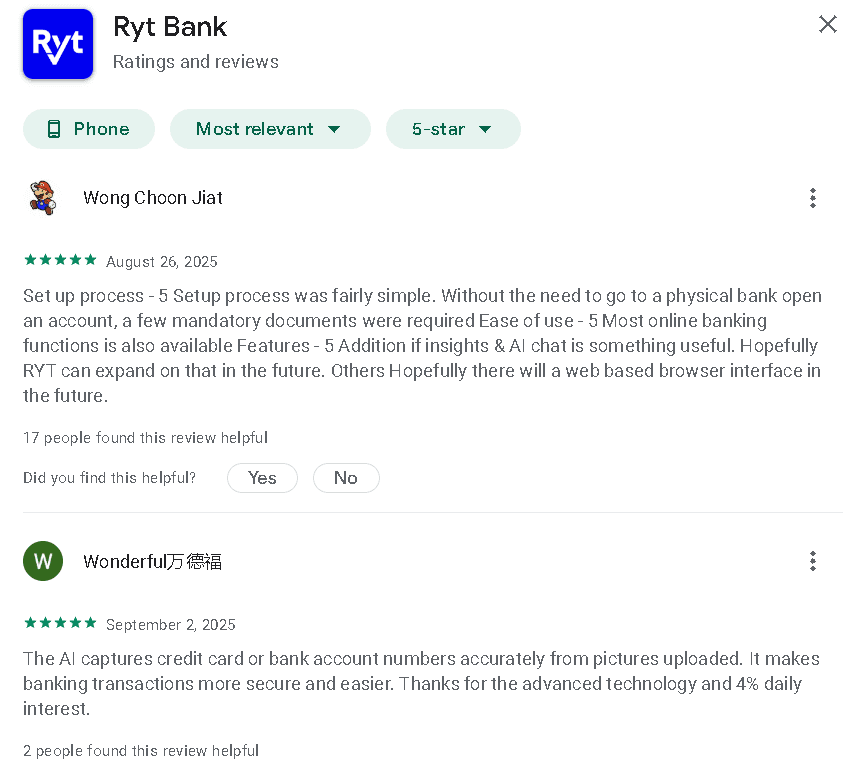

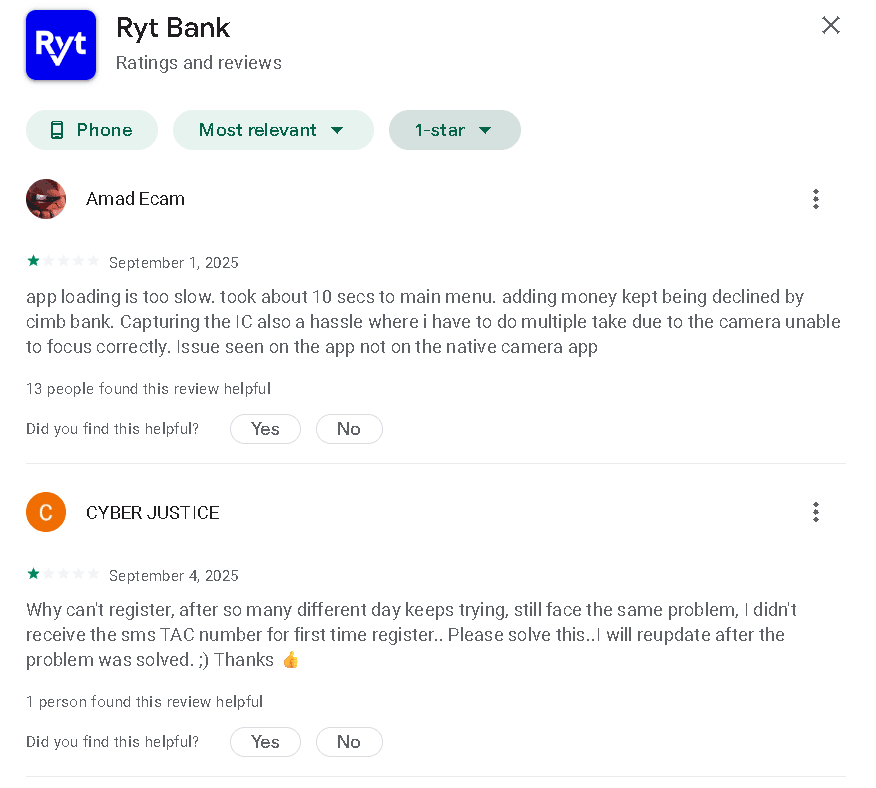

Ryt Bank Review – Google Play Store Rating and Comment

The latest reviews further reflect the strengths and weaknesses of the Ryt Bank app:

- Wong Choon Jiat (5 stars, August 26, 2025)

- Positive points: The setup process is simple, requiring minimal documents. The app’s ease of use and online banking features are appreciated, with the added value of AI chat and insights. Users look forward to future improvements like a web-based interface.

- Wonderful万德福 (5 stars, September 2, 2025)

- Positive points: The AI feature accurately captures credit card and bank account numbers from images, making banking transactions easier and more secure.

- Amad Ecam (1 star, September 1, 2025)

- Negative points: App loading time is slow. Users face issues with adding money and difficulty in capturing ID images, as the camera does not focus correctly, which is an issue with the app and not the native camera.

- CYBER JUSTICE (1 star, September 4, 2025)

- Negative points: Difficulty in registering due to not receiving the SMS TAC number. The user expresses frustration with the issue and promises to update the review after it’s resolved.

The latest reviews of Ryt Bank highlight a mix of positive and negative experiences. Users appreciate the easy setup, secure transaction handling through AI, and additional features like AI chat and insights. However, there are issues with app performance, such as slow loading times, difficulties with capturing images (especially ID cards), and problems registering due to missing SMS TAC numbers. While some users are excited about the app’s potential and security features, others struggle with functionality and performance, leading to frustration.

What the Media Says About Ryt Bank

- Lowyat.net: “The AI assistant isn’t perfect yet, but the onboarding process is one of the fastest we’ve tested in Malaysia.” (Source: https://www.lowyat.net/2025/319670/ryt-bank-review-hands-on-ai-first-digital-bank/)

- SoyaCincau: “Ryt Bank aims to differentiate itself by letting you pay bills with just a screenshot or voice command.” (Source: https://soyacincau.com/2025/03/ryt-bank-digital-bank-malaysia-launch)

- Vulcan Post: “While GXBank and AEON Bank compete on loyalty perks, Ryt Bank is betting on AI as its unique edge.” (Source: https://vulcanpost.com/2025/03/ryt-bank-malaysia-ai-digital-bank/)

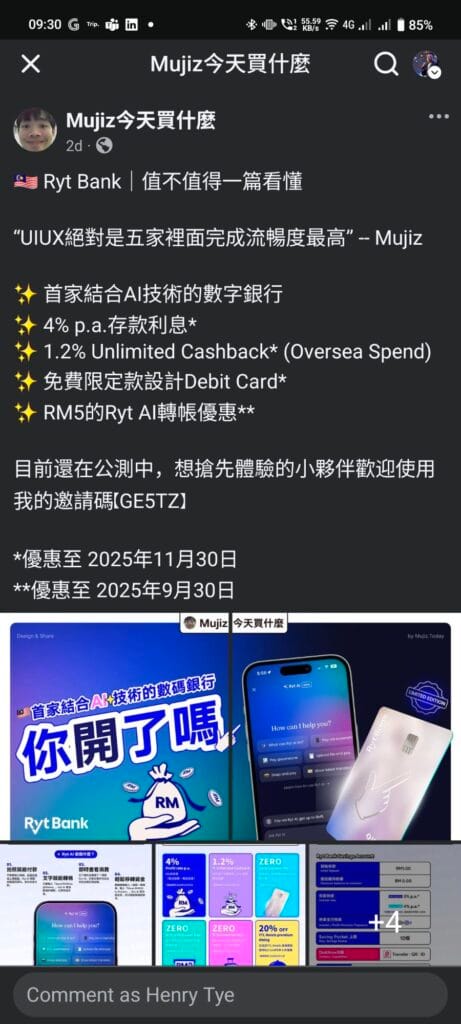

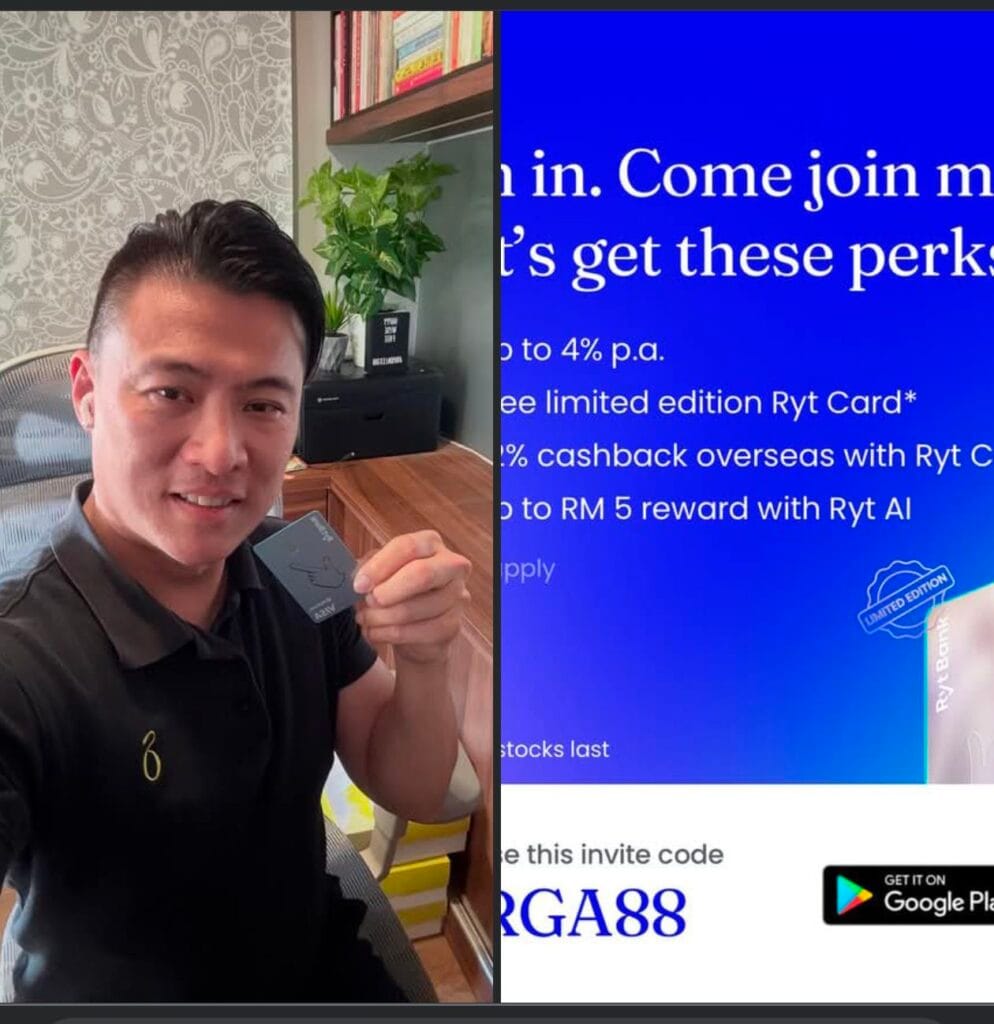

Promotions and Banking Highlights

- Campaigns showcase perks such as:

- Up to 4% p.a. interest

- Free limited edition Ryt Card

- 1.2% cashback on overseas spend

- RM5 reward for Ryt AI transfers

- Promo expiry dates: cashback and interest perks until 30 Nov 2025, RM5 reward until 30 Sept 2025.

- Influencers including Ku Chun Loong, Mujiz, and Zing Gadget promoted limited-edition and holographic debit cards, with engagement stats in the hundreds of likes, comments, and shares.

Timeline of Ryt Bank Launch Events

- 2021: Bank Negara Malaysia grants five digital banking licences. YTL Digital Bank Berhad, a consortium with Sea Limited, awarded one of the licences.

- 2023–2024: Preparation and pilot testing phase. Development of Ryt AI based on YTL’s ILMU large language model.

- March 2025: Public unveiling of Ryt Bank as Malaysia’s first AI-powered digital bank. Early Access waitlist begins.

- April 2025: Selected early adopters invited. Influencers and tech reviewers share onboarding experiences, highlighting fast registration and daily interest perks.

- August 2025: Social media campaigns intensify, featuring limited edition debit card promotions and influencer reels.

- September 2025: Promos include waived card issuance fees and waived foreign transaction fees until end of month. Wider roll-out across Malaysia expected.

- Future (2026 and beyond): Expansion into SME and B2B products, JomPAY support, broader language availability, and continued AI improvements.

Comparison with Other Digital Banks in Malaysia

- GXBank: Offers savings account with 3.0% p.a. interest, strong integration with Grab ecosystem. No AI features.

- AEON Bank: Targets retail customers with loyalty tie-ins. Interest rates around 3.5% p.a. No AI integration.

- Boost Bank: Focused on eWallet and small business ecosystem. Moderate daily interest and microloans.

- KAF Bank: Concentrated on wholesale/Islamic banking, less retail exposure.

- Ryt Bank: Differentiates with AI-powered banking flows and daily interest with AI-assisted convenience features. As Vulcan Post noted, “Ryt Bank is betting on AI as its unique edge” (Vulcan Post).

Ryt Bank FAQ

Is Ryt Bank safe in Malaysia?

Yes. Ryt Bank is licensed by Bank Negara Malaysia and deposits are protected under PIDM up to RM250,000.

Can foreigners open Ryt Bank accounts?

Currently, community feedback suggests accounts are limited to Malaysians with MyKad. No official foreigner onboarding yet.

What is Ryt AI?

Ryt AI is a digital assistant built into the Ryt Bank app. It can prepare transactions from text, voice, or uploaded images, but requires manual approval.

How is Ryt Bank different from GXBank or AEON Bank?

Ryt Bank is the only AI-driven digital bank in Malaysia, while GXBank focuses on Grab ecosystem integration and AEON Bank emphasizes loyalty rewards. SoyaCincau highlights that Ryt Bank’s selling point is bill payments via screenshots or voice (SoyaCincau).

What are the current promotions?

Up to 4% p.a. savings interest, 1.2% overseas cashback, and waived card issuance and foreign transaction fees until Sept 2025.

How to Register for Ryt Bank

- Download the Ryt Bank app from App Store or Google Play.

- Enter mobile number and verify.

- Scan MyKad and complete selfie verification.

- Submit employment and income details.

- Approval usually within minutes (up to 48 hours).

- Virtual debit card available instantly.

- Physical card delivered within a few days (fee waived until Sept 2025).

Customer Support: support@rytbank.my | +603-5115 5115 (8am–10pm daily)

Next Steps & Outlook for Ryt Bank Malaysia

- JomPAY support and expanded bill coverage.

- Wider language options including Mandarin and Tamil.

- SME and B2B financial products expected.

- Greater clarity on invite/referral model.

- Transparency on AI data usage and privacy policies.

What’s Next for Ryt Bank in Malaysia?

Upcoming Features:

- Expanded Language Support: Mandarin and Tamil will be added soon to make the app more accessible.

- SME & B2B Products: Ryt Bank is set to expand its services to small businesses and corporate clients.

- Improved AI Capabilities: Expect better AI integration, including JomPAY support and more accurate transaction processing.

Looking Ahead:

- Ryt Bank is a bold step towards AI-powered banking in Malaysia, and its future will depend on refining AI technology and addressing user concerns about security and reliability.

References & Sources

- Ryt Bank Official: https://rytbank.my

- Early Access FAQ: https://rytbank.my/earlyaccess

- Lowyat.net Review: https://www.lowyat.net/2025/319670/ryt-bank-review-hands-on-ai-first-digital-bank/

- SoyaCincau Launch Coverage: https://soyacincau.com/2025/03/ryt-bank-digital-bank-malaysia-launch

- Vulcan Post Malaysia: https://vulcanpost.com/2025/03/ryt-bank-malaysia-ai-digital-bank/

- Reddit Malaysia: https://reddit.com/r/malaysia

- ASEAN AI Summit 2025 (ILMU launch)

Discover more from CollaMedia 酷乐新媒体

Subscribe to get the latest posts sent to your email.